Interconnectedness

In January 2016, we experienced the worst 10 day start of the stock market since 1897. I’m an economics

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

In January 2016, we experienced the worst 10 day start of the stock market since 1897. I’m an economics

The reality is this; When our Creator was giving out gifts and talents, h/she provided us many, but patience was

‘World politics matter’ a statement to which you naturally respond “No (kidding), Sherlock”. This monthly communication is to state

This will cover three events, all very different in their base topic but collectively germane as to how financial

“When in the Course of human events, it becomes necessary for one people to dissolve….” We normally write this

When in the annals of finance we see people trying to usurp historically held ‘facts’, we should pay attention

The primary message this month; Some things go well, and some go poorly. Sure, big deal, that’s life you say.

You know the old adage; “There ain’t no such thing as a free lunch”? Well, it is true in

Inflation is a beast we want to mostly keep in his cage. Some of us remember the remarkable days

In January 2016, we experienced the worst 10 day start of the stock market since 1897. I’m an economics history guy and that’s saying

The reality is this; When our Creator was giving out gifts and talents, h/she provided us many, but patience was most assuredly not one of

‘World politics matter’ a statement to which you naturally respond “No (kidding), Sherlock”. This monthly communication is to state that world financial systems also

This will cover three events, all very different in their base topic but collectively germane as to how financial markets work. First, unless you

“When in the Course of human events, it becomes necessary for one people to dissolve….” We normally write this letter toward the beginning of

When in the annals of finance we see people trying to usurp historically held ‘facts’, we should pay attention to see if something has

The primary message this month; Some things go well, and some go poorly. Sure, big deal, that’s life you say. However, and VERY IMPORTANT, before

You know the old adage; “There ain’t no such thing as a free lunch”? Well, it is true in the world of economics as

Inflation is a beast we want to mostly keep in his cage. Some of us remember the remarkable days of the 1980’s when inflation

It ‘tis the season…no, not that one, the other one. Therefore, let’s talk about a little history but do so from the financial side

In January 2016, we experienced the worst 10 day start of the stock market since 1897. I’m an economics

The reality is this; When our Creator was giving out gifts and talents, h/she provided us many, but patience was

‘World politics matter’ a statement to which you naturally respond “No (kidding), Sherlock”. This monthly communication is to state

This will cover three events, all very different in their base topic but collectively germane as to how financial

“When in the Course of human events, it becomes necessary for one people to dissolve….” We normally write this

When in the annals of finance we see people trying to usurp historically held ‘facts’, we should pay attention

The primary message this month; Some things go well, and some go poorly. Sure, big deal, that’s life you say.

You know the old adage; “There ain’t no such thing as a free lunch”? Well, it is true in

Inflation is a beast we want to mostly keep in his cage. Some of us remember the remarkable days

It ‘tis the season…no, not that one, the other one. Therefore, let’s talk about a little history but do

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

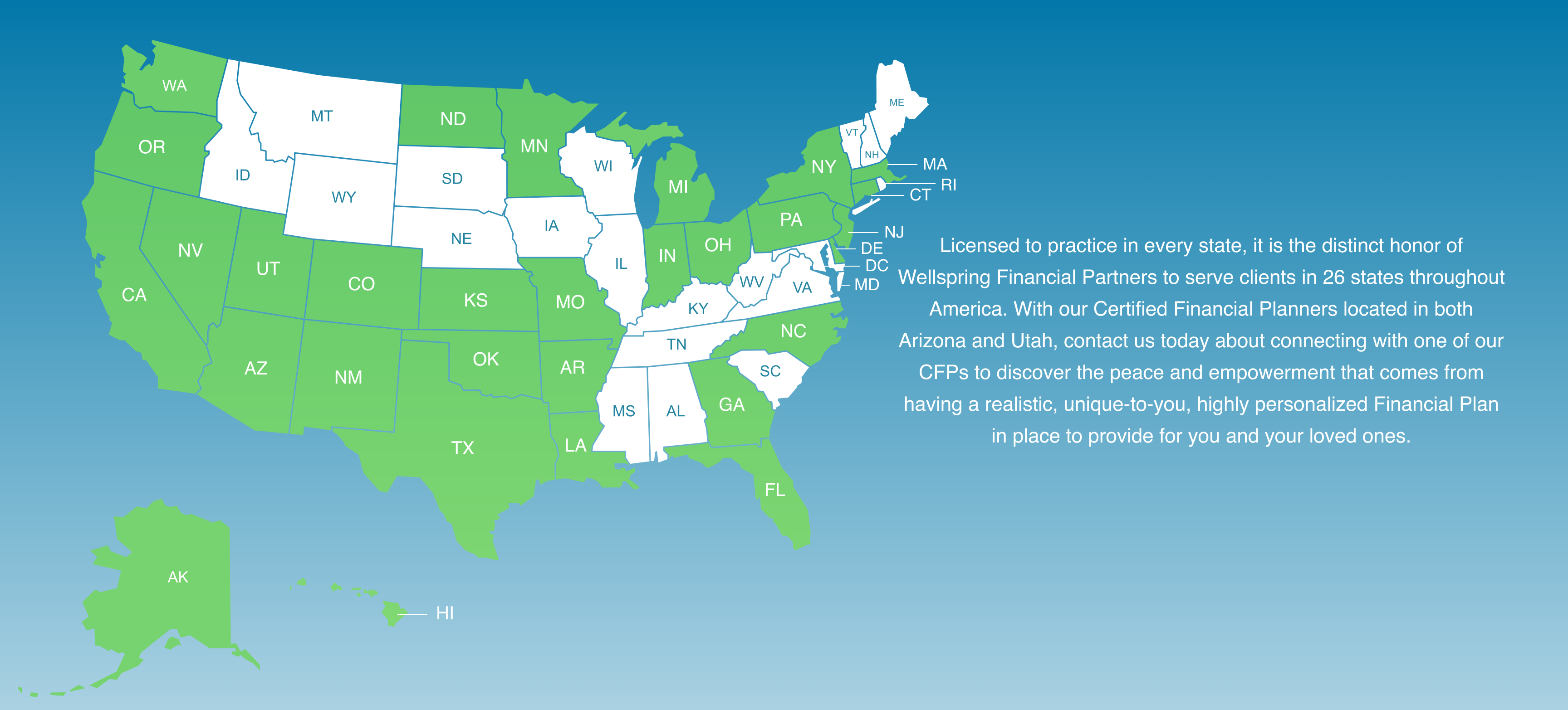

4703 E. Camp Lowell Drive

Suite 135

Tucson, AZ 85712

Salt Lake City, UT

Monday – Friday:

8:00am-4:30pm

520-327-1019

1-844-203-2402

contact@wellspringfp.com

wellspringfinancialpartners.com

4703 E. Camp Lowell Drive

Suite 135

Tucson, AZ 85712

Salt Lake City, UT

Monday – Friday:

8:00am-4:30pm

1-844-203-2402

contact@wellspringfp.com

http://wellspringfin.wpenginepowered.com