How to Build a Strong Financial Foundation for Your Future

Building a robust financial foundation is akin to constructing a house; it requires careful planning, solid materials, and ongoing maintenance.

*Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

Building a robust financial foundation is akin to constructing a house; it requires careful planning, solid materials, and ongoing maintenance.

Navigating the world of financial planning can often seem overwhelming, especially for beginners. Terms like stocks, bonds, retirement plans, and

Small business owners face a myriad of challenges, and managing finances effectively is paramount to their success. Wellspring Financial Partners®

For financial success for individuals and businesses alike, the art of managing debt and building credit stands as a pivotal

Saving for retirement is essential, and starting as soon as possible helps you take advantage of compounding interest. However, it

Saving for retirement is a fundamental aspect of financial planning and helps you work toward a secure and comfortable future.

Managing how much money your household spends compared to your income is a foundational financial skill. By understanding your cash

If you’ve just received a raise, congratulations! Getting a well-deserved pay increase is an exciting feeling. It can also be

156.3 million Total number of U. S. non-farm employees in July 2023. By comparison, the pre-pandemic hight was 152.4 million

27.7 Percentage of retirement plan participants making contributions to a Roth 401(k) paln in 2021 Source: Plan Sponsor Council of

Building a robust financial foundation is akin to constructing a house; it requires careful planning, solid materials, and ongoing maintenance. In the realm of personal

Navigating the world of financial planning can often seem overwhelming, especially for beginners. Terms like stocks, bonds, retirement plans, and investment strategies might sound complex,

Small business owners face a myriad of challenges, and managing finances effectively is paramount to their success. Wellspring Financial Partners® understands the unique financial needs

For financial success for individuals and businesses alike, the art of managing debt and building credit stands as a pivotal skill. Wellspring Financial Partners® recognizes

Saving for retirement is essential, and starting as soon as possible helps you take advantage of compounding interest. However, it can also be a daunting

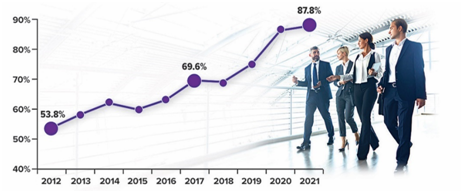

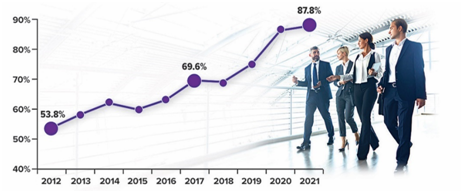

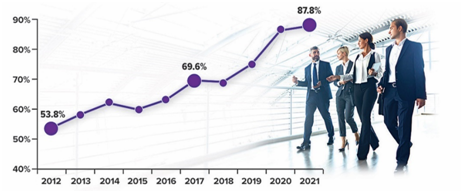

Saving for retirement is a fundamental aspect of financial planning and helps you work toward a secure and comfortable future. A significant number of individuals

Managing how much money your household spends compared to your income is a foundational financial skill. By understanding your cash flow, you can gain awareness

If you’ve just received a raise, congratulations! Getting a well-deserved pay increase is an exciting feeling. It can also be a great opportunity to reassess

156.3 million Total number of U. S. non-farm employees in July 2023. By comparison, the pre-pandemic hight was 152.4 million in February 2020, and the

27.7 Percentage of retirement plan participants making contributions to a Roth 401(k) paln in 2021 Source: Plan Sponsor Council of America, 2022Roth 401(k) plans can

Building a robust financial foundation is akin to constructing a house; it requires careful planning, solid materials, and ongoing maintenance.

Navigating the world of financial planning can often seem overwhelming, especially for beginners. Terms like stocks, bonds, retirement plans, and

Small business owners face a myriad of challenges, and managing finances effectively is paramount to their success. Wellspring Financial Partners®

For financial success for individuals and businesses alike, the art of managing debt and building credit stands as a pivotal

Saving for retirement is essential, and starting as soon as possible helps you take advantage of compounding interest. However, it

Saving for retirement is a fundamental aspect of financial planning and helps you work toward a secure and comfortable future.

Managing how much money your household spends compared to your income is a foundational financial skill. By understanding your cash

If you’ve just received a raise, congratulations! Getting a well-deserved pay increase is an exciting feeling. It can also be

156.3 million Total number of U. S. non-farm employees in July 2023. By comparison, the pre-pandemic hight was 152.4 million

27.7 Percentage of retirement plan participants making contributions to a Roth 401(k) paln in 2021 Source: Plan Sponsor Council of

Licensed to practice in every state, it is the distinct honor of Wellspring Financial Partners to serve clients in 30 states throughout America. With our CERTIFIED FINANCIAL PLANNER® professionals located in both Arizona and Utah, contact us today about connecting with one of our CFP® Professionals to discover the peace and empowerment that comes from having a realistic, unique-to-you, highly personalized Financial Plan in place to provide for you and your loved ones.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

4703 E. Camp Lowell Drive

Suite 135

Tucson, AZ 85712

Monday – Friday:

8:00am-4:30pm

520-327-1019

1-844-203-2402

contact@wellspringfp.com

wellspringfinancialpartners.com