When Do You

Need a

Financial Planner?

When Do You Need a Financial Planner?

The Answer… Yesterday!

Money management is complicated and it doesn’t get any easier without skilled investment advice.

The reality is that it’s tough, even unlikely, to live your life successfully – to plan your financial life – in an optimal way without good help and advice. We all need to save money, but we need to save different amounts of money at different times in our life or we are out of balance. We believe so firmly in this notion of providing dependable advice that we give everyone a $3,000-$7,000 financial plan for less than 1/10th that amount ($320 to be specific). No financial planner in the country does that and there are absolutely no strings attached.

Your Financial Life

When you get your first real job, money management is relatively simple. You pay your bills, put aside a little fun money, and if you are smart, you save what’s left for the future. Easy!

In time, many meet their life partners and suddenly there are two incomes, and two lives, to consider. The next step is often to start looking for a home, which brings along mortgage and insurance considerations. You also start thinking about the what-ifs in life. How would we weather unexpected challenges, like losing one of our incomes, or both? The notion of retirement, although still a distant thought, is nonetheless a real-life consideration.

Next, you may decide to have children. Medical insurance becomes a bigger challenge. How do you use a Health Savings Account to save for future healthcare needs? How will you help your children with college and how much debt will they/you need to take on? At this point, retirement thoughts start becoming more prevalent. Your money management is no longer easy… it is getting more complicated.

The day comes that retirement is no longer an eternity away, but at your front door, and the million-dollar questions are: Can you retire? Did you save enough to maintain your quality of life? What retirement and tax mechanisms are right for you and your partner?

This is just one example of how the trajectory of your financial life could play out, and each person’s situation is different. However, the overall sentiment rings true that over time, managing your money tends to become more complicated. Getting a financial planner can help you manage this. Doing so earlier is ideal, but a Wellspring advisor can assist you at any point, starting with where you currently are.

Financial Planning Statistics

A study by Morningstar found that advice from a financial advisor can add 29% more wealth through retirement.1

MORE WEALTH

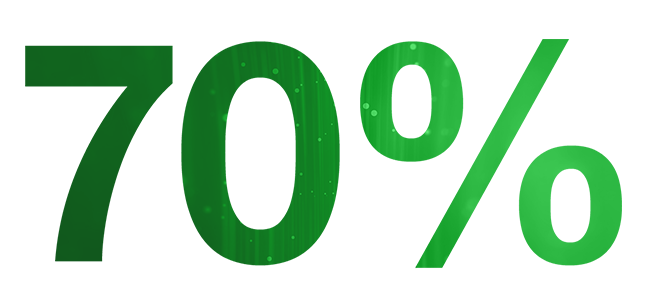

ON TRACK OR AHEAD

John Hancock Retirement Plan Services also conducted a recent study and found that 70% of those who work with a financial advisor or planner are on track or ahead in saving for retirement.2

The Benefits of a Good Financial Planner

Wellspring can help you with the daunting number of financial questions at each stage of your life. Whether you are starting your first job or in your later years, your financial advisor can provide the expertise and resources to guide you through all of these complicated real-life decisions.

Critical Values of a Financial Advisor

Organization

Bring structure to your financial life

Assist in defining your financial needs, desires, and goals

Accountability

Help you follow through on financial commitments

Work with you to prioritize goals, show you the steps, and regularly review your progress

Objectivity

Bring insight from the outside to help you avoid emotionally-driven financial decisions

Consult at key moments of decision-making

Proactivity

Work with you to anticipate your life transitions so you can be financially prepared for them

Regularly assess any potential life changes and create an action plan

Education

Bring specific knowledge necessary for success based on your situation

Explain your options and risks to facilitate your decisions

Partnership

Work together so you can achieve the best possible outcome

Take the time to genuinely understand your background, philosophy, and life goals

Wellspring Can Help You

Wellspring Financial Partners® is dedicated to bringing all six of the above critical values to you, our client. It is our core belief that our worth is measured by how well we help you reach your financial goals.

From your initial game plan through your retirement years, Wellspring effectively co-creates a highly interactive relationship that provides knowledgeable, professional planning and the best possible chance for your financial success.

This is How We Do It

We SUPPORT you by providing personal attention.

1 Alpha, Beta, and Now…Gamma Morningstar 2013

2 The 2015 John Hancock Financial Stress Survey was commissioned by John Hancock and conducted by Greenwald and Associates. The data is exclusive to the experience of John Hancock’s mid/large market retirement plan clients.