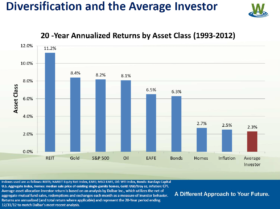

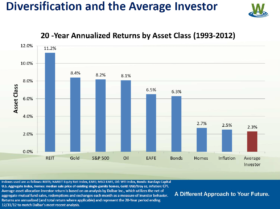

Should You Have Alternatives in Your Lineup?

The term “alternative investments” may conjure images of classic automobiles, fine wine, rare art and valuable jewels. Some may think

*Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

The term “alternative investments” may conjure images of classic automobiles, fine wine, rare art and valuable jewels. Some may think

The Employee Retirement Income Security Act (ERISA) was enacted in 1974 to protect employees who participate in retirement plans and

Here are some questions to ask yourself when deciding whether or not you are ready to retire. Is your nest

Most private employers have already replaced traditional pensions, which promise lifetime income payments in retirement, with defined contribution plans such

Buying a home can be a major expenditure. Fortunately, federal tax benefits of homeownership are available to make homeownership more

Traditional investment indexes such as the S&P 500 are weighted based on market capitalization, the value of a company’s total

In a Walk Kelly comic strip there was a possum named Pogo, and in the 1971 Earth Day posting Pogo

Defined contribution (DC) plan committees face increasing scrutiny on the myriad of decisions they make for their respective plans. During

Any committee member sitting through their share of plan investment review meetings has heard the term “large cap” come up

Bond ratings are an essential tool when considering fixed-income investments. Ratings provide a professional assessment of credit risk, or the

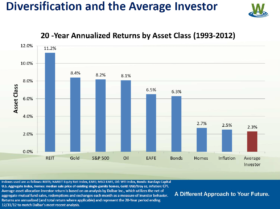

The term “alternative investments” may conjure images of classic automobiles, fine wine, rare art and valuable jewels. Some may think about the Honus Wagner baseball

The Employee Retirement Income Security Act (ERISA) was enacted in 1974 to protect employees who participate in retirement plans and certain other employee benefit plans.

Here are some questions to ask yourself when deciding whether or not you are ready to retire. Is your nest egg adequate? It may be

Most private employers have already replaced traditional pensions, which promise lifetime income payments in retirement, with defined contribution plans such as 401(k)s. But 15% of

Buying a home can be a major expenditure. Fortunately, federal tax benefits of homeownership are available to make homeownership more affordable and less expensive. There

Traditional investment indexes such as the S&P 500 are weighted based on market capitalization, the value of a company’s total outstanding stock. This means the

In a Walk Kelly comic strip there was a possum named Pogo, and in the 1971 Earth Day posting Pogo uttered the philosophical revelation; “We

Defined contribution (DC) plan committees face increasing scrutiny on the myriad of decisions they make for their respective plans. During committee meetings, it’s no longer

Any committee member sitting through their share of plan investment review meetings has heard the term “large cap” come up quite frequently. In our experience,

Bond ratings are an essential tool when considering fixed-income investments. Ratings provide a professional assessment of credit risk, or the risk of default, which can

The term “alternative investments” may conjure images of classic automobiles, fine wine, rare art and valuable jewels. Some may think

The Employee Retirement Income Security Act (ERISA) was enacted in 1974 to protect employees who participate in retirement plans and

Here are some questions to ask yourself when deciding whether or not you are ready to retire. Is your nest

Most private employers have already replaced traditional pensions, which promise lifetime income payments in retirement, with defined contribution plans such

Buying a home can be a major expenditure. Fortunately, federal tax benefits of homeownership are available to make homeownership more

Traditional investment indexes such as the S&P 500 are weighted based on market capitalization, the value of a company’s total

In a Walk Kelly comic strip there was a possum named Pogo, and in the 1971 Earth Day posting Pogo

Defined contribution (DC) plan committees face increasing scrutiny on the myriad of decisions they make for their respective plans. During

Any committee member sitting through their share of plan investment review meetings has heard the term “large cap” come up

Bond ratings are an essential tool when considering fixed-income investments. Ratings provide a professional assessment of credit risk, or the

Licensed to practice in every state, it is the distinct honor of Wellspring Financial Partners to serve clients in 30 states throughout America. With our CERTIFIED FINANCIAL PLANNER® professionals located in both Arizona and Utah, contact us today about connecting with one of our CFP® Professionals to discover the peace and empowerment that comes from having a realistic, unique-to-you, highly personalized Financial Plan in place to provide for you and your loved ones.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

4703 E. Camp Lowell Drive

Suite 135

Tucson, AZ 85712

Monday – Friday:

8:00am-4:30pm

520-327-1019

1-844-203-2402

contact@wellspringfp.com

wellspringfinancialpartners.com