What to Expect When Transitioning Providers

The thought of transitioning from one service provider to another may be intimidating and overwhelming. It doesn’t have to be. If

*Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

The thought of transitioning from one service provider to another may be intimidating and overwhelming. It doesn’t have to be. If

The Internal Revenue Service (IRS) allows distributions to be excluded from income if they are rolled over to an eligible

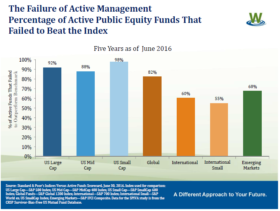

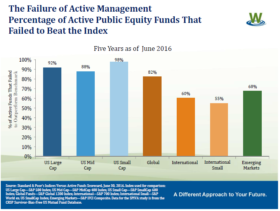

We always try to do things right for you at Wellspring Financial Partners ®. Now, you’d expect that we would

We always try to do things right for you at Wellspring Financial Partners ®. Now, you’d expect that I would

I thought it worthwhile to view the world of ‘work’ over a period of say… 5,000 years just for the

I thought it worthwhile to view the world of ‘work’ over a period of about 3 or so millennium! Let’s

(The Answer ….…..Yesterday!) When you get your first real job, money management is relatively simple. You pay your bills, put

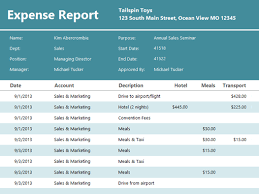

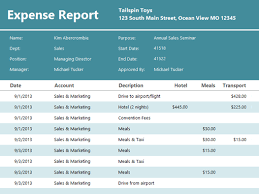

The payment of expenses by an ERISA plan (401(k), defined benefit plan, money purchase plan, etc.) out of plan assets

As a plan sponsor and fiduciary of your company’s retirement plan, keeping an up-to-date fiduciary file is critical. To begin,

After years of proposed regulation issuance, comment periods, drafting and anticipation, the Department of Labor (DOL) finally published final guidance regarding the definition

The thought of transitioning from one service provider to another may be intimidating and overwhelming. It doesn’t have to be. If you work with an experienced

The Internal Revenue Service (IRS) allows distributions to be excluded from income if they are rolled over to an eligible retirement plan or Individual Retirement

We always try to do things right for you at Wellspring Financial Partners ®. Now, you’d expect that we would say that and, to be

We always try to do things right for you at Wellspring Financial Partners ®. Now, you’d expect that I would say that and, to be

I thought it worthwhile to view the world of ‘work’ over a period of say… 5,000 years just for the sake of convenience. And, in

I thought it worthwhile to view the world of ‘work’ over a period of about 3 or so millennium! Let’s round it to 5,000 years

(The Answer ….…..Yesterday!) When you get your first real job, money management is relatively simple. You pay your bills, put aside a little fun money,

The payment of expenses by an ERISA plan (401(k), defined benefit plan, money purchase plan, etc.) out of plan assets is subject to ERISA’s fiduciary

As a plan sponsor and fiduciary of your company’s retirement plan, keeping an up-to-date fiduciary file is critical. To begin, we recommend preparing your file

After years of proposed regulation issuance, comment periods, drafting and anticipation, the Department of Labor (DOL) finally published final guidance regarding the definition of “fiduciary” on April 8, 2016.

The thought of transitioning from one service provider to another may be intimidating and overwhelming. It doesn’t have to be. If

The Internal Revenue Service (IRS) allows distributions to be excluded from income if they are rolled over to an eligible

We always try to do things right for you at Wellspring Financial Partners ®. Now, you’d expect that we would

We always try to do things right for you at Wellspring Financial Partners ®. Now, you’d expect that I would

I thought it worthwhile to view the world of ‘work’ over a period of say… 5,000 years just for the

I thought it worthwhile to view the world of ‘work’ over a period of about 3 or so millennium! Let’s

(The Answer ….…..Yesterday!) When you get your first real job, money management is relatively simple. You pay your bills, put

The payment of expenses by an ERISA plan (401(k), defined benefit plan, money purchase plan, etc.) out of plan assets

As a plan sponsor and fiduciary of your company’s retirement plan, keeping an up-to-date fiduciary file is critical. To begin,

After years of proposed regulation issuance, comment periods, drafting and anticipation, the Department of Labor (DOL) finally published final guidance regarding the definition

Licensed to practice in every state, it is the distinct honor of Wellspring Financial Partners to serve clients in 30 states throughout America. With our CERTIFIED FINANCIAL PLANNER® professionals located in both Arizona and Utah, contact us today about connecting with one of our CFP® Professionals to discover the peace and empowerment that comes from having a realistic, unique-to-you, highly personalized Financial Plan in place to provide for you and your loved ones.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

4703 E. Camp Lowell Drive

Suite 135

Tucson, AZ 85712

Monday – Friday:

8:00am-4:30pm

520-327-1019

1-844-203-2402

contact@wellspringfp.com

wellspringfinancialpartners.com