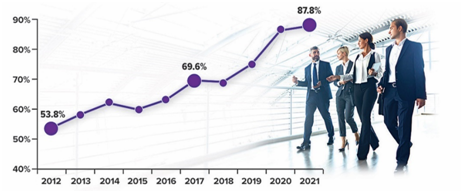

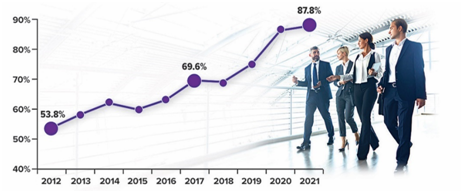

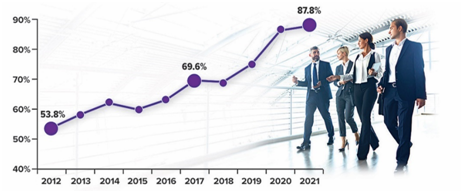

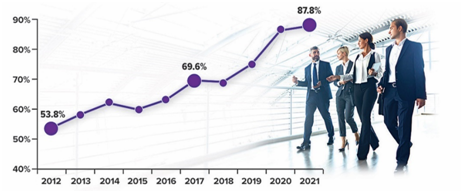

Employee Access to Roth 401(k) Plans on the Rise

27.7 Percentage of retirement plan participants making contributions to a Roth 401(k) paln in 2021 Source: Plan Sponsor Council of

*Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

27.7 Percentage of retirement plan participants making contributions to a Roth 401(k) paln in 2021 Source: Plan Sponsor Council of

At Wellspring Financial Partners®, we believe that a successful retirement is not simply about reaching a certain age; it’s about

Starting August 29, student loan payments will be back on after a 3-year pause. What does this mean for plan

Understandably, companies typically devote considerable attention to assisting participants nearing retirement. But the outsized value of early contributions to retirement

According to recent data from the National Council on Aging and the Women’s Institute for a Secure Retirement, nearly half

When it comes to planning for your financial future, it’s important to have the right resources in order to make

Insurance is a financial mechanism designed to provide a safety net against unforeseen events that might adversely impact an individual’s

A financial crisis — such as a job loss or medical emergency — can strike when you least expect it.

An effective retirement plan should be based on your particular circumstances. No one strategy is suitable for everyone. Once you’re

When it comes to managing your finances, making sure you have the best plan for your needs is essential. A

27.7 Percentage of retirement plan participants making contributions to a Roth 401(k) paln in 2021 Source: Plan Sponsor Council of America, 2022Roth 401(k) plans can

At Wellspring Financial Partners®, we believe that a successful retirement is not simply about reaching a certain age; it’s about embracing a new chapter of

Starting August 29, student loan payments will be back on after a 3-year pause. What does this mean for plan sponsors? As employees prepare to,

Understandably, companies typically devote considerable attention to assisting participants nearing retirement. But the outsized value of early contributions to retirement readiness means employers should also

According to recent data from the National Council on Aging and the Women’s Institute for a Secure Retirement, nearly half of women ages 25 and

When it comes to planning for your financial future, it’s important to have the right resources in order to make well-thought-out decisions. Working with a

Insurance is a financial mechanism designed to provide a safety net against unforeseen events that might adversely impact an individual’s or a company’s financial position.

A financial crisis — such as a job loss or medical emergency — can strike when you least expect it. It is important to be

An effective retirement plan should be based on your particular circumstances. No one strategy is suitable for everyone. Once you’re retired, your income plan should

When it comes to managing your finances, making sure you have the best plan for your needs is essential. A financial advisor can provide invaluable

27.7 Percentage of retirement plan participants making contributions to a Roth 401(k) paln in 2021 Source: Plan Sponsor Council of

At Wellspring Financial Partners®, we believe that a successful retirement is not simply about reaching a certain age; it’s about

Starting August 29, student loan payments will be back on after a 3-year pause. What does this mean for plan

Understandably, companies typically devote considerable attention to assisting participants nearing retirement. But the outsized value of early contributions to retirement

According to recent data from the National Council on Aging and the Women’s Institute for a Secure Retirement, nearly half

When it comes to planning for your financial future, it’s important to have the right resources in order to make

Insurance is a financial mechanism designed to provide a safety net against unforeseen events that might adversely impact an individual’s

A financial crisis — such as a job loss or medical emergency — can strike when you least expect it.

An effective retirement plan should be based on your particular circumstances. No one strategy is suitable for everyone. Once you’re

When it comes to managing your finances, making sure you have the best plan for your needs is essential. A

Licensed to practice in every state, it is the distinct honor of Wellspring Financial Partners to serve clients in 30 states throughout America. With our CERTIFIED FINANCIAL PLANNER® professionals located in both Arizona and Utah, contact us today about connecting with one of our CFP® Professionals to discover the peace and empowerment that comes from having a realistic, unique-to-you, highly personalized Financial Plan in place to provide for you and your loved ones.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

4703 E. Camp Lowell Drive

Suite 135

Tucson, AZ 85712

Monday – Friday:

8:00am-4:30pm

520-327-1019

1-844-203-2402

contact@wellspringfp.com

wellspringfinancialpartners.com