What are the new rules for 401(k) hardship withdrawals?

The Bipartisan Budget Act passed in early 2018 relaxed some of the rules governing hardship withdrawals from 401(k)s and similar

*Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

The Bipartisan Budget Act passed in early 2018 relaxed some of the rules governing hardship withdrawals from 401(k)s and similar

As people move through different stages of life, there are few financial opportunities — and potential pitfalls — around every corner.

A health savings account (HSA) is a tax-advantaged account that you can establish and contribute to if you are enrolled

Outstanding student loan debt in the United States has tripled over the last decade, surpassing both auto and credit card

One advantage of term life insurance is that it is generally the most cost-effective way to achieve the maximum life

If you’re saving for a child’s college education, at some point you’ll want to familiarize yourself with a college net

For the 2019-2020 school year, the federal government’s financial aid form, the FAFSA, can be filed as early as October

Comparatively speaking, of all the different types of life insurance available, term is usually the least expensive. Generally, term life

On your journey to retirement, you’ll likely face many risks that have the potential to throw you off course. Following

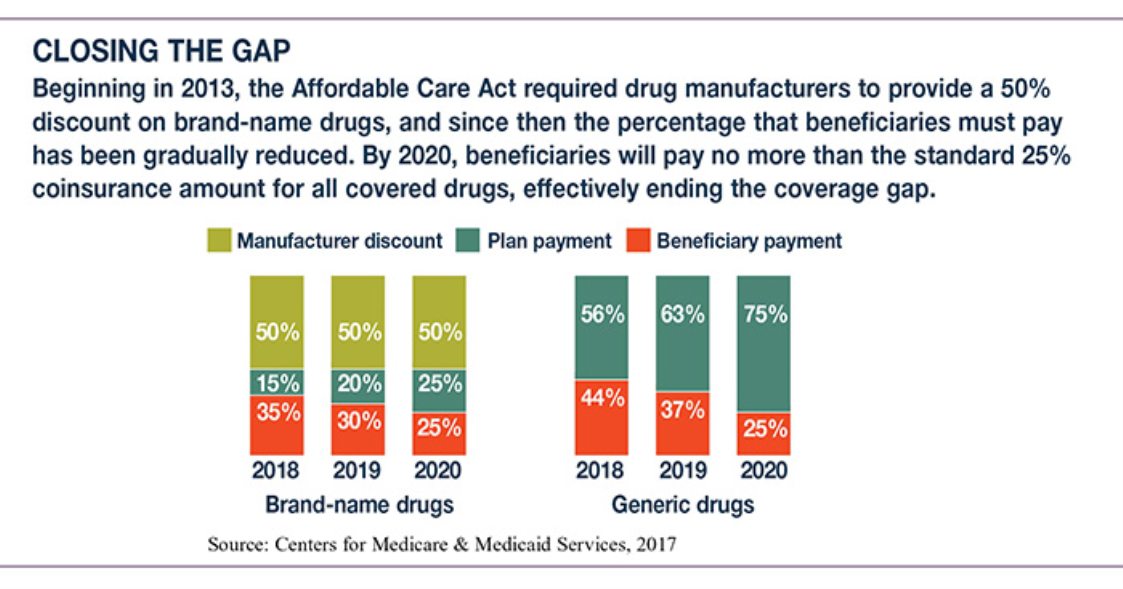

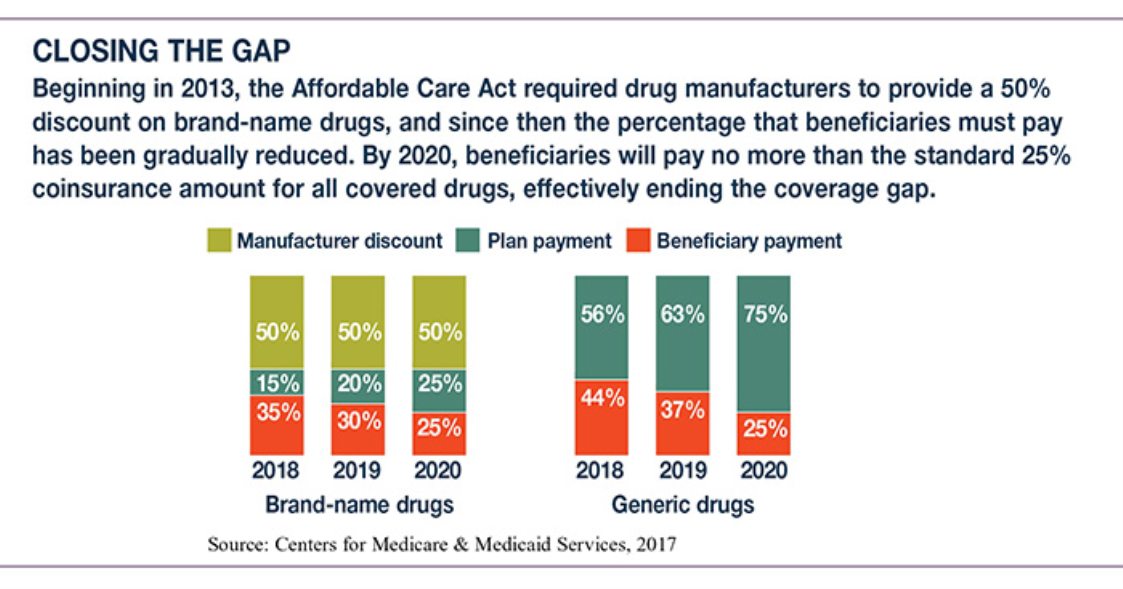

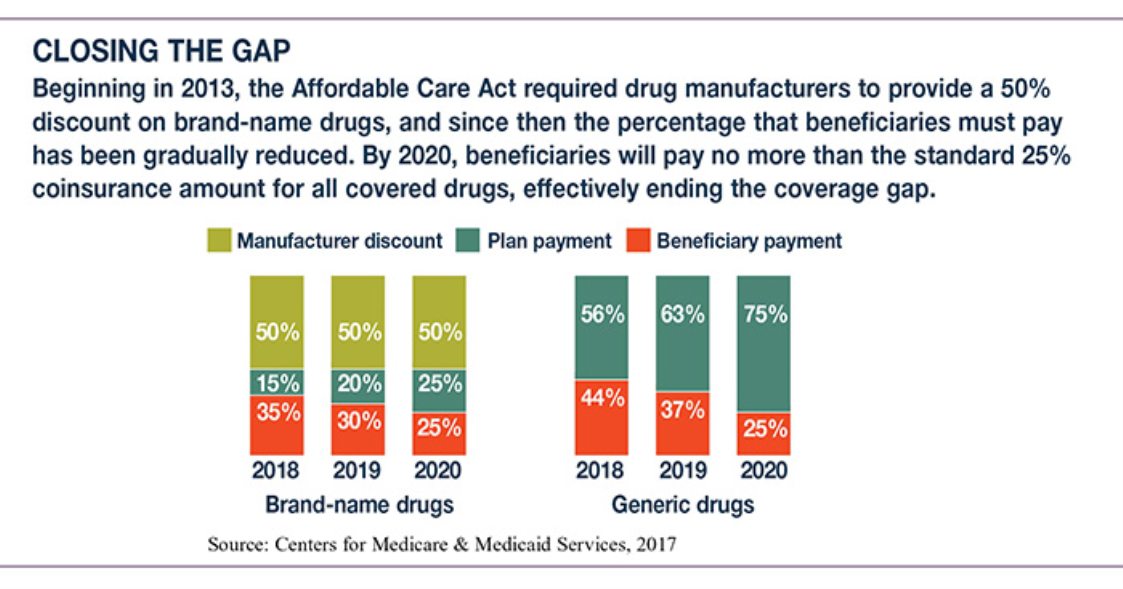

One of the most confusing Medicare provisions is the prescription drug coverage gap, often called the “donut hole.” It may

The Bipartisan Budget Act passed in early 2018 relaxed some of the rules governing hardship withdrawals from 401(k)s and similar plans. Not all plans offer

As people move through different stages of life, there are few financial opportunities — and potential pitfalls — around every corner. Have you made any of

A health savings account (HSA) is a tax-advantaged account that you can establish and contribute to if you are enrolled in a high-deductible health plan

Outstanding student loan debt in the United States has tripled over the last decade, surpassing both auto and credit card debt to take second place

One advantage of term life insurance is that it is generally the most cost-effective way to achieve the maximum life insurance protection you can afford.

If you’re saving for a child’s college education, at some point you’ll want to familiarize yourself with a college net price calculator, which is an

For the 2019-2020 school year, the federal government’s financial aid form, the FAFSA, can be filed as early as October 1, 2018. It relies on

Comparatively speaking, of all the different types of life insurance available, term is usually the least expensive. Generally, term life insurance provides protection for a

On your journey to retirement, you’ll likely face many risks that have the potential to throw you off course. Following are five common challenges retirement

One of the most confusing Medicare provisions is the prescription drug coverage gap, often called the “donut hole.” It may be clearer if you consider

The Bipartisan Budget Act passed in early 2018 relaxed some of the rules governing hardship withdrawals from 401(k)s and similar

As people move through different stages of life, there are few financial opportunities — and potential pitfalls — around every corner.

A health savings account (HSA) is a tax-advantaged account that you can establish and contribute to if you are enrolled

Outstanding student loan debt in the United States has tripled over the last decade, surpassing both auto and credit card

One advantage of term life insurance is that it is generally the most cost-effective way to achieve the maximum life

If you’re saving for a child’s college education, at some point you’ll want to familiarize yourself with a college net

For the 2019-2020 school year, the federal government’s financial aid form, the FAFSA, can be filed as early as October

Comparatively speaking, of all the different types of life insurance available, term is usually the least expensive. Generally, term life

On your journey to retirement, you’ll likely face many risks that have the potential to throw you off course. Following

One of the most confusing Medicare provisions is the prescription drug coverage gap, often called the “donut hole.” It may

Licensed to practice in every state, it is the distinct honor of Wellspring Financial Partners to serve clients in 30 states throughout America. With our CERTIFIED FINANCIAL PLANNER® professionals located in both Arizona and Utah, contact us today about connecting with one of our CFP® Professionals to discover the peace and empowerment that comes from having a realistic, unique-to-you, highly personalized Financial Plan in place to provide for you and your loved ones.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

4703 E. Camp Lowell Drive

Suite 135

Tucson, AZ 85712

Monday – Friday:

8:00am-4:30pm

520-327-1019

1-844-203-2402

contact@wellspringfp.com

wellspringfinancialpartners.com