Medical Debt and Your Credit Report

It’s no surprise that consumers are contacted by debt collectors about medical bills more than any other type of debt.1

*Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

It’s no surprise that consumers are contacted by debt collectors about medical bills more than any other type of debt.1

Here are some things to consider as you weigh potential tax moves before the end of the year. Set Aside

The SECURE 2.0 Act, passed in late 2022, included numerous provisions affecting retirement savings plans, including some that impact required

In 2003, the U.S. was emerging from the dot-com recession, unemployment rates were peaking during a jobless recovery, and online

156.3 million Total number of U. S. non-farm employees in July 2023. By comparison, the pre-pandemic hight was 152.4 million

If you’ve recently received an inheritance, you may be facing many important decisions. Receiving an inheritance might promote spending without

If your employer offers health insurance benefits, one of your options may be a high-deductible health plan (HDHP) with eligibility

A notable shift in public opinion over the past decade about the value of a college degree may portend a

27.7 Percentage of retirement plan participants making contributions to a Roth 401(k) paln in 2021 Source: Plan Sponsor Council of

A financial crisis — such as a job loss or medical emergency — can strike when you least expect it.

It’s no surprise that consumers are contacted by debt collectors about medical bills more than any other type of debt.1 After all, the complex world

Here are some things to consider as you weigh potential tax moves before the end of the year. Set Aside Time to Plan Effective planning

The SECURE 2.0 Act, passed in late 2022, included numerous provisions affecting retirement savings plans, including some that impact required minimum distributions (RMDs). Here is

In 2003, the U.S. was emerging from the dot-com recession, unemployment rates were peaking during a jobless recovery, and online shopping was becoming more popular.

156.3 million Total number of U. S. non-farm employees in July 2023. By comparison, the pre-pandemic hight was 152.4 million in February 2020, and the

If you’ve recently received an inheritance, you may be facing many important decisions. Receiving an inheritance might promote spending without planning, but don’t make any

If your employer offers health insurance benefits, one of your options may be a high-deductible health plan (HDHP) with eligibility for a health savings account

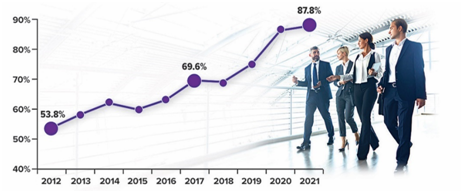

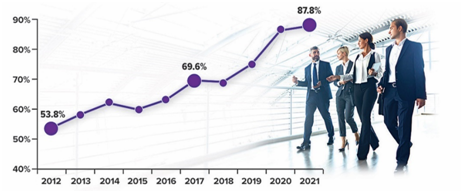

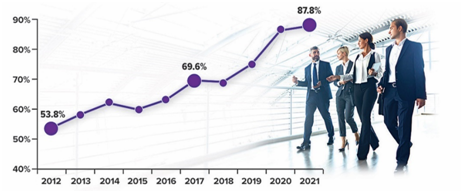

A notable shift in public opinion over the past decade about the value of a college degree may portend a reckoning for the higher education

27.7 Percentage of retirement plan participants making contributions to a Roth 401(k) paln in 2021 Source: Plan Sponsor Council of America, 2022Roth 401(k) plans can

A financial crisis — such as a job loss or medical emergency — can strike when you least expect it. It is important to be

It’s no surprise that consumers are contacted by debt collectors about medical bills more than any other type of debt.1

Here are some things to consider as you weigh potential tax moves before the end of the year. Set Aside

The SECURE 2.0 Act, passed in late 2022, included numerous provisions affecting retirement savings plans, including some that impact required

In 2003, the U.S. was emerging from the dot-com recession, unemployment rates were peaking during a jobless recovery, and online

156.3 million Total number of U. S. non-farm employees in July 2023. By comparison, the pre-pandemic hight was 152.4 million

If you’ve recently received an inheritance, you may be facing many important decisions. Receiving an inheritance might promote spending without

If your employer offers health insurance benefits, one of your options may be a high-deductible health plan (HDHP) with eligibility

A notable shift in public opinion over the past decade about the value of a college degree may portend a

27.7 Percentage of retirement plan participants making contributions to a Roth 401(k) paln in 2021 Source: Plan Sponsor Council of

A financial crisis — such as a job loss or medical emergency — can strike when you least expect it.

Licensed to practice in every state, it is the distinct honor of Wellspring Financial Partners to serve clients in 30 states throughout America. With our CERTIFIED FINANCIAL PLANNER® professionals located in both Arizona and Utah, contact us today about connecting with one of our CFP® Professionals to discover the peace and empowerment that comes from having a realistic, unique-to-you, highly personalized Financial Plan in place to provide for you and your loved ones.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

4703 E. Camp Lowell Drive

Suite 135

Tucson, AZ 85712

Monday – Friday:

8:00am-4:30pm

520-327-1019

1-844-203-2402

contact@wellspringfp.com

wellspringfinancialpartners.com