Four Questions on the Roth Five-Year Rule

The Roth “five-year rule” typically refers to when you can take tax-free distributions of earnings from your Roth IRA, Roth

*Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

The Roth “five-year rule” typically refers to when you can take tax-free distributions of earnings from your Roth IRA, Roth

The first part of 2020 was rocky, but there should be better days ahead. Taking a close look at your

Recent college graduates aren’t the only ones carrying student loan debt. A significant number of older Americans have student debt,

Below is a communication that Wellspring Financial Partners ® has prepared to help participants understand the potential relief available to

Imagine that you receive an email with an urgent message asking you to verify your banking information by clicking on

Whether it’s a helpful announcement from your child’s school or an appointment reminder from a doctor’s office, getting robocalls has

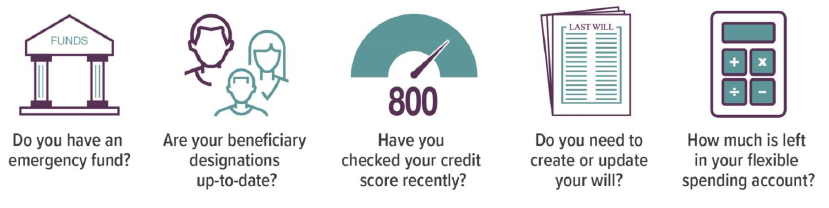

Spring is a good time to clean out the cobwebs, and not just in your home or apartment. Your personal

The Setting Every Community Up For Retirement Enhancement (SECURE) Act, which was passed in December 2019 as part of a

Tax filing season is here again. If you haven’t done so already, you’ll want to start pulling things together –

Most lenders use credit report information to evaluate the creditworthiness of potential borrowers. Borrowers with good credit are presumed to

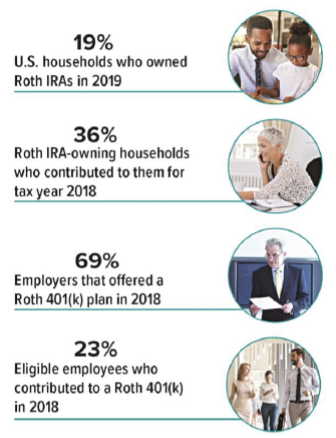

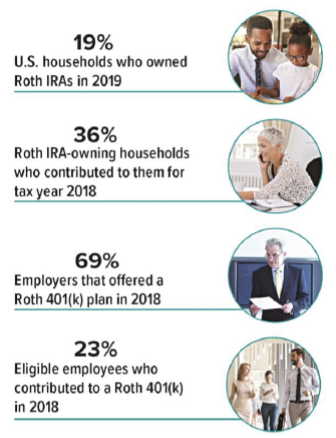

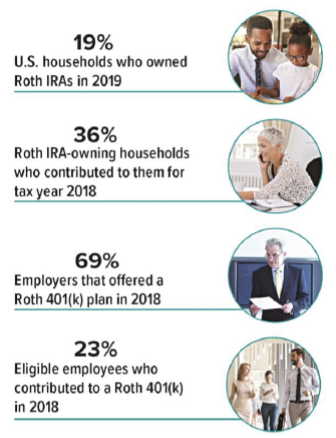

The Roth “five-year rule” typically refers to when you can take tax-free distributions of earnings from your Roth IRA, Roth 401(k), or other work-based Roth

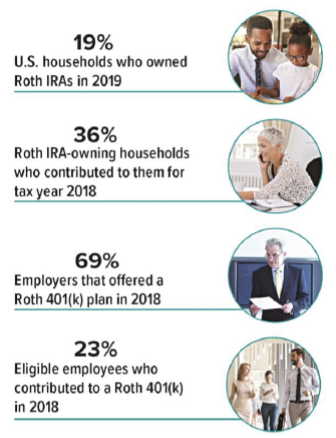

The first part of 2020 was rocky, but there should be better days ahead. Taking a close look at your finances may give you the

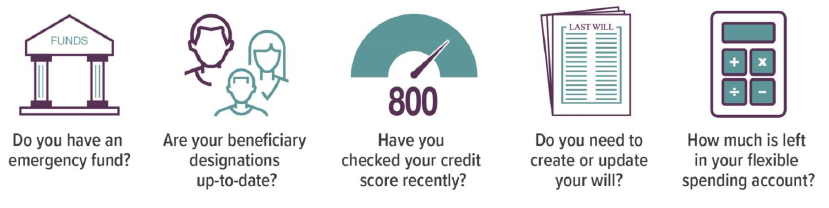

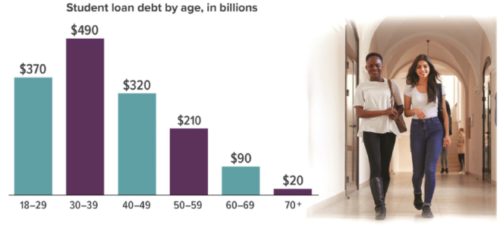

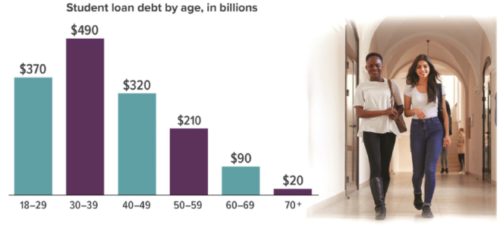

Recent college graduates aren’t the only ones carrying student loan debt. A significant number of older Americans have student debt, too. In fact, student loan

Below is a communication that Wellspring Financial Partners ® has prepared to help participants understand the potential relief available to them and their families through

Imagine that you receive an email with an urgent message asking you to verify your banking information by clicking on a link. Or perhaps you

Whether it’s a helpful announcement from your child’s school or an appointment reminder from a doctor’s office, getting robocalls has become an everyday occurrence. Unfortunately,

Spring is a good time to clean out the cobwebs, and not just in your home or apartment. Your personal finances can benefit from a

The Setting Every Community Up For Retirement Enhancement (SECURE) Act, which was passed in December 2019 as part of a larger federal spending package, included

Tax filing season is here again. If you haven’t done so already, you’ll want to start pulling things together – that includes getting your hands

Most lenders use credit report information to evaluate the creditworthiness of potential borrowers. Borrowers with good credit are presumed to be more creditworthy and may

The Roth “five-year rule” typically refers to when you can take tax-free distributions of earnings from your Roth IRA, Roth

The first part of 2020 was rocky, but there should be better days ahead. Taking a close look at your

Recent college graduates aren’t the only ones carrying student loan debt. A significant number of older Americans have student debt,

Below is a communication that Wellspring Financial Partners ® has prepared to help participants understand the potential relief available to

Imagine that you receive an email with an urgent message asking you to verify your banking information by clicking on

Whether it’s a helpful announcement from your child’s school or an appointment reminder from a doctor’s office, getting robocalls has

Spring is a good time to clean out the cobwebs, and not just in your home or apartment. Your personal

The Setting Every Community Up For Retirement Enhancement (SECURE) Act, which was passed in December 2019 as part of a

Tax filing season is here again. If you haven’t done so already, you’ll want to start pulling things together –

Most lenders use credit report information to evaluate the creditworthiness of potential borrowers. Borrowers with good credit are presumed to

Licensed to practice in every state, it is the distinct honor of Wellspring Financial Partners to serve clients in 30 states throughout America. With our CERTIFIED FINANCIAL PLANNER® professionals located in both Arizona and Utah, contact us today about connecting with one of our CFP® Professionals to discover the peace and empowerment that comes from having a realistic, unique-to-you, highly personalized Financial Plan in place to provide for you and your loved ones.

Award based on independent survey carried out by USA TODAY and Statista. Firms need to be nominated by a participant in the survey. No prior registration is required, and no costs are involved for the nomination. The recommendations for each firm are summarized and evaluated anonymously. In addition to the survey results, additional metrics (e.g., data in relation to assets under management (AUM)) will be included in the final analysis.

4703 E. Camp Lowell Drive

Suite 135

Tucson, AZ 85712

Monday – Friday:

8:00am-4:30pm

520-327-1019

1-844-203-2402

contact@wellspringfp.com

wellspringfinancialpartners.com