Without Congressional Action the Social Security Trust Funds will be Exhausted in 2034

- If current trends continue, the Social Security trust funds will be completely depleted in 2034. This is according to the most recent annual report published by the Trustees of Social Security. This is one year sooner than was projected in last year’s report.

- While the media often portrays the situation as more dire than it is, if Congress does not effect changes before 2034, there will have to be a reduction in scheduled benefits. The only fixes are to increase payroll taxes, cut benefits or a combination of the two. Without a fix, it is estimated that when the trust funds are exhausted Social Security will only have enough income to pay approximately 80 percent of scheduled benefits.

- Social Security has always run on a “pay-as-you-go” basis. A major overhaul was required in 1983 to keep the System solvent. Congress moved the retirement age out to reflect increasing life expectancies and greatly increased payroll taxes.

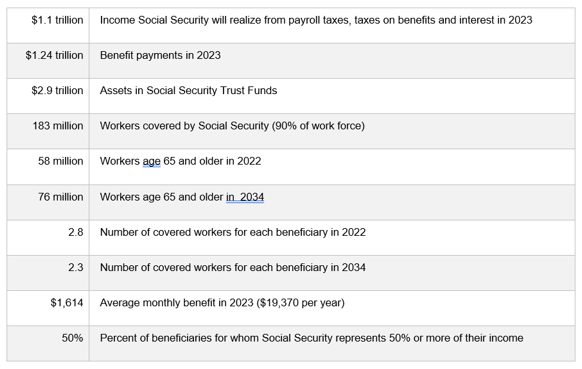

- Following these changes, for almost three decades, income received by Social Security exceeded benefits paid. As a result, the trust funds have accumulated $2.9 trillion in assets. The cash flow surpluses realized by Social Security were borrowed by the federal government to meet its current needs. As a result, the assets in the trust funds consist entirely of US Treasuries. Arguably, this approach made sense as it allowed the government to meet its financial needs without borrowing more from the public.

- For the first time in 2021, benefits paid by Social Security exceeded income. If these deficits continue, the trust funds will be exhausted in 2034.

- Factors adversely affecting Social Security’s finances include an economic slowdown, persistent inflation and weaker productivity growth. This is compounded by two demographic trends. The aging of the population due to declining birth rates and the wave of retirements. Approximately 10,000 “baby boomers” are retiring every day.

- The Trustees annual report includes 75-year projections for the System. Over this period, the Trustees estimate the shortfall between income and scheduled benefits will represent 2 percent of GDP.

- Many commentators have stated that delays by Congress in making necessary reforms increases the deficit. This is not correct. The Increasing deficits are an artifact of the 75-year projections. Each year another year is added to the 75-year projection period with a relatively large deficit.

- However, it does make sense for Congress to act sooner rather than later as the burden of necessary changes will be borne by more age groups. The continued delay means younger workers will shoulder a greater portion of any changes.

- Also, continued delay increases the size of necessary tax increases or benefit reductions. The Trustees estimate that an immediate increase in the payroll tax to 15.84 percent, or a 21.3 percent cut in benefits, would make Social Security solvent for the next 75 years. The current tax is 12.4 percent, divided equally between employers and employees.

Social Security Stats

For any further questions, please do not hesitate to email Wellspring Financial Partners® at info@wellspringfp.com or call 1 (844) 203-2402. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. A proud member of RPAG.