In last month’s newsletter I said I would address the Top 7 Steps To Financial Success. I continue with #2 in this letter: Saving money. The topic itself sounds boring to most people. Yet the unfettered truth is that this step is so dominant in importance that it’s 2nd on the Big 7 list because it is foundational to the other 5 that will follow.

Let’s start by setting some context to the by-products of saving. Those by-products will emphasize the critical nature of why this step is necessary. I’ll follow this quick context opening by characterizing the significant shortcoming in saving rates in the country today. Finally, I’ll provide a few ‘cheater’ ideas to help people save and begin to turn the tide.

The by-products of saving read like a motivational recital, but they are all factual as can be:

- If you don’t save money, you are never in control. Never. Ever. We live in a society where things cost money (thus we are commonly referred to as a consumer driven society). If you don’t have savings, you simply are forever dependent on someone else.

- If you are a client of Wellspring, you have money. Maybe a little… maybe a lot…but with money saved / invested you have options. If don’t have money, you don’t have options. The lack of options can be very aggravating.

- Everyone wants to talk about return rates on their investments. As a very deep-in-the-weeds finance guy, I am extremely adamant that investors deserve great returns. However, if you don’t save money, the concept of ‘return on my money’ is a null void conversation. It was Ben Franklin who purportedly said: “A penny saved is a penny earned” (a massive 100% return) and that is why that adage stayed around forever.

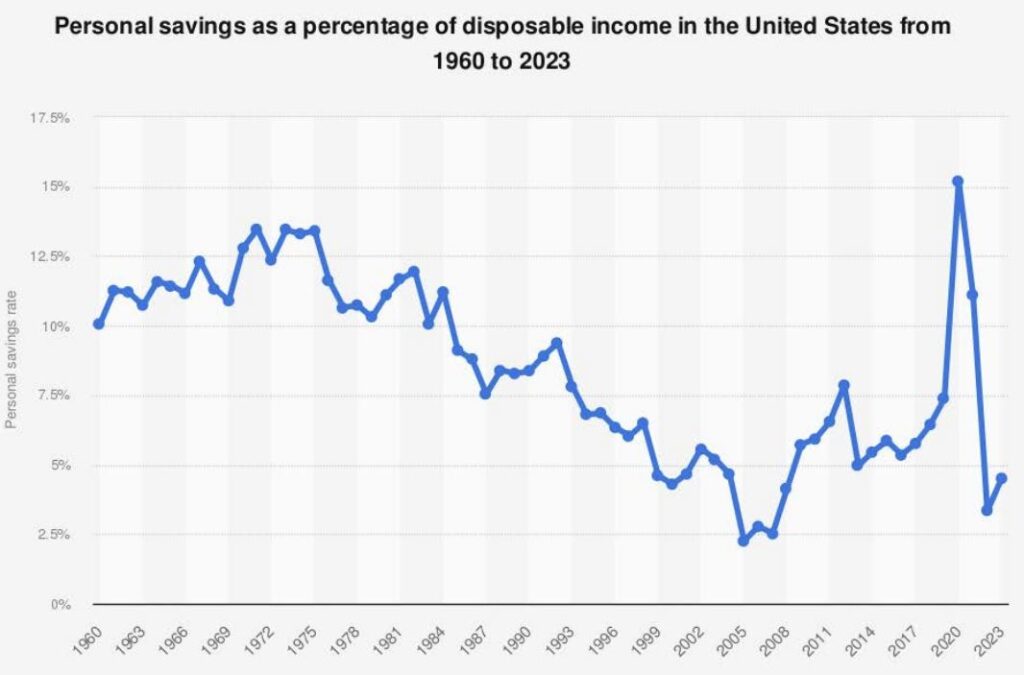

One of the greatest indicators we are growing our national financial stress problem is the falling rate of savings in this country. Every family’s appropriate savings rate is different but the old adage of ‘save 10% of your income’ came from practical advice. Notwithstanding that stalwart advice, here are some indications we’re going the wrong way.

- Savings rates have declined dramatically over the past 3-4 years. What formerly was in that 7%-8% range has come crashing down. Current savings rates at between 3.6% – 4.5%[i] are now at one of their lowest levels in 50-60 years (see graph below).

The medium total retirement savings for households in the United States is $87,000 (half the country below that level, and half above)[ii]. At that level, the maximum a 65-year-old could pull out would be a little over $200 per month. That level just doesn’t float a lot of boats.

- The level of financial stress for Americans now exceeds any other level of stress experienced (physical, job, relationship) at 65%, with nearly half all surveyed saying 2024 was the most stressful year of their lives financially.[iii]

- Beyond financial stress itself, we know it is dramatically impacting emotional / physical health of employees and that impacts the productivity of employees as well. Current data says a financially stressed employee spends 3 ½ hours per week dealing with money issues. Further, 56% of employees said financial stress affected their sleep, 55% their mental health, 50% their self-esteem, 44% their physical health, and 40% their relationships at home.

Given all the above, we can readily process that saving money builds independence and improves our health, not just our financial health. We thus need to save more. A few ideas to help are:

- People need to save something. Just start; Do something. Seeing balances grow in account size is more psychologically impactful than reading any frig’in book. That uplifting view helps stress levels go down.

- Budgeting how much to spend is needed because without it, you will be unthinkingly going out to eat, shopping online and getting the latest iPhones. All consume money — and the data says people suffer the greatest regrets later in life from making those expenditures. Spending might buy “things” — but it does not buy happiness. And it doesn’t just hit the lower income households. Higher income people buy fancy cars, homes and watches that they later regret.[iv] On money, it’s always a matter of trade-offs; Financial independence and individual freedom has to be a greater draw than status symbol buys. As Will Rogers’s once said:

“Too many people spend money they haven’t earned to buy things they don’t want to impress people they don’t like.”

- There’s a group of households known as the FIRE people: Financial Independence Retire Early. That aspiration isn’t right for everyone, but what they DO get right is judging trade-offs much more critically (how often do I NEED to buy a car, etc.). Almost without exception the people who have extra money to spend don’t waste money frivolously – EVEN THOUGH THEY COULD. Everyone has limits. There’s a new term called ‘subscription creep’ , which reflects that people easily sign up for some monthly app on their phones….but they never take it off. Latest research data says people believe they spend $80 per month on these subscriptions but the real number is $238 per month[v], 197% more!

It’s Labor Day weekend. Appreciate that unless people get an inheritance, households accumulate wealth when they save money earned from their labors, their hard work. I admire those hard-working people, whether that career is as a custodian or a surgeon. This hard work should be uplifting to the soul, but the savings that come from it is uplifting to one’s standard of living. Saving money maybe isn’t ‘fun’, but those that do it can still laugh all the way to the bank.

It remains my deep honor and distinct privilege to serve you well.

Patrick Zumbusch

Founder and CEO

[i] “Americans are saving less these days. Here’s why and what that means” (Bryan Mena, CNN Business, April 24, 2024)

[ii] “What Is the Average Retirement Savings by Age?” (Alana Benson, NerdWallet, May 7, 2024)

[iii] “Financial Stress Survey: 65% of Americans Say Finances Are Their Biggest Source of Stress” (Dhara Singh, MarketWatch Guides, August 9, 2024)

[iv] “What Was I Thinking?’ The Big-Ticket Items People Regret” (Beth DeCarbo, Wall Street Journal, May 19, 2024)

[v] “How much are you actually paying for your monthly subscriptions?” (Louisiana Federal Credit Union)