Yes, it’s nearly time for the Easter Bunny, and I hope your favorite chocolates appear along-side your peeps and colored eggs. However, in this letter I’d like to talk about a fundamental economic building block and that is the importance of population growth…or more specifically, the lack of it. Everyone wants to talk about stock prices and economic growth, but I note that it is seldom appreciated that you need to produce people if you want to produce growth.

Many factors drive individual security stock price increases or declines, but today I’m addressing the bigger issue of what drives national economic growth. On a micro level, you need to have great products and services offered at attractive prices to grow an individual company. On a macro level, we combine all those individual products and services to determine if we are growing or shrinking as a country, and we commonly measure the 200 plus countries on this planet earth economically in acronyms often called GNP or GDP. Rather than simply being an academic subject, we should actually care about increases GNP (Gross National Product) or GDP (Gross Domestic Product) because a country’s standard of living generally goes up if those measured results go up – and who doesn’t want a higher standard of living? Now, having laid down all of this crucial monetary groundwork, you should know that the two primary factors propelling national growth are the growth in population (labor) combined with the growth in productivity (which measures worker efficiency). So now (hopefully) you can see why we’re concerned with the egg; Economists care about demographics (population growth) because it’s a key factor in determining a country’s long-term growth potential. And…therein is the problem; We are not producing labor at a sufficient enough rate.

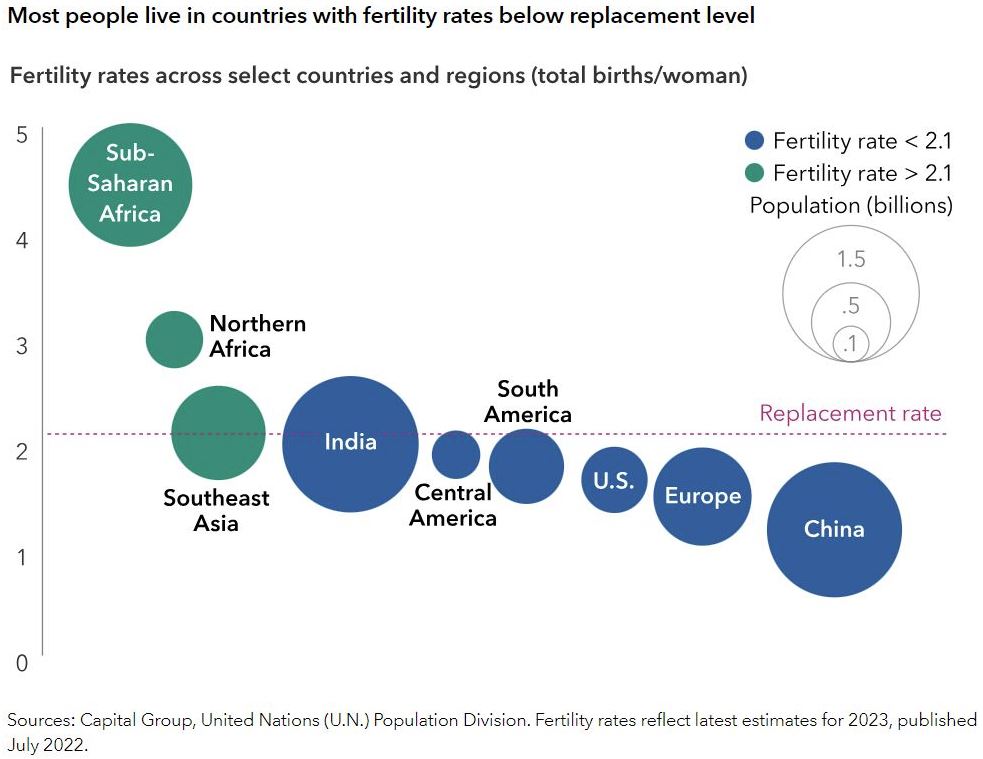

Over every 50-year period in U.S. history, the population has grown at least 50 percent, sometimes by far more. For the first third of my life — and you might remember this too – the big concern was we’re going to have too many people on this planet, and we couldn’t feed them all. In 1798, Thomas Robert Malthus published his Essay on the Principle of Population. It proved to be one of the most enduring works of the time. Malthus’s fundamental argument was that population growth will inevitably collide with diminishing returns. This view led to the chanted mantra of the 1960’s and 1970’s of another acronym; ZPG, or Zero Population Growth. Mr. Malthus got more than a few things wrong, and one of those was his inability to foresee the gains in output that could be achieved through increased use of physical capital and new technologies in agriculture. Still, the scare of scarcity was big enough that China, still a babe in the economic woods at that time, began to enforce its ‘one child’ policy. That national policy is now uniformly decried as disastrous. Technically speaking, in order to create an expanding population pool, you need a fertility rate of 2.1 or more. The 2.1 is referred to as the ‘replacement rate’. If the average of births per woman in a country was 2.1 or more, the population would go up. If the fertility rate is 2.1 or less, the national population will decline. The below graph shows select countries of the world in a most recent estimate:

Taking the above data and projecting out 30–70 years from now, we see forecasts of world populations hitting their peak in 2053 or 2086:

At one time it had been assumed that women in richer countries would have more children as their economic resources would be able to absorb the additional costs of child-rearing. That result did not happen. More recently, many Nordic countries have tried financial incentives to encourage women to have babies, but those programs have barely moved the needle, if at all. Japan, perhaps the most studied example of a shrinking society, shows the population tsunami it can be. In 2008, Japan reported a population decline of 20,000. By 2023, that figured had ballooned to 831,872[i]. Prime Minister Fumio Kishida called the trend “the gravest crisis our country faces”.

The implications of lower population growth are not just lower economic growth, but lower tax revenues collected by government entities as well. We see these effects most dramatically in the United States when we look at social systems like Medicare and Social Security where the ratio of young workers (paying in) to retirees (taking out) has dropped from 5.1 in 1960 to 2.8 in 2022.[ii] Thus the common man’s term of ‘Social Security is going bankrupt’ is functionally correct.

An offsetting effect to the above population decline could come from a new technology called Artificial Intelligence (AI). As much as there exists the potential for abuse in this technology and perhaps too much hype for it in the financial marketplace, there is no doubt at all that improved robotics and efficiencies could accrue to a society to make up for the shortfall in the labor force. We will see tremendous developments in the next 10-years from this still nascent evolution and it will certainly help balance the effects of the population decline.

A further mostly unrecognized offset to fertility rates occurs uniquely to the United States; immigration. We certainly can’t avoid the hot political topic of current border problems, but migration to this country has largely been a boon to our economics. While the U.S. population represents about 5 percent of the total world population, close to 20 percent of all global migrants reside in the United States.[iii] Research by the American Immigration Council finds that nearly half of today’s Fortune 500 companies were founded by either immigrants or the children of immigrants, including four of the top 12: Apple; founded by the son of a Syrian immigrant; Google (now Alphabet), cofounded by a Russian immigrant; Amazon, founded by the son of a Cuban immigrant; and Costco, founded by the son of Canadian immigrants whose family had emigrated from Romania (taken together, these companies employ nearly 2.2 million workers). Speaking purely economically, we are one bonehead country if we don’t find a way to retain these bright foreign nationals who get their degrees in our universities and constantly pepper us with new company formations, or the uneducated migrant workers who pick unpicked peppers in California and New Mexico.

I have long espoused the view that the greatest resource a company has available is not in its intellectual property war chest or its financial resources, but in the hearts and minds of its employees. As a country, I’m not saying we need to put all our eggs in one basket, but successful countries need to recognize one of the most limited of resources in the world will soon not be the nickel in the ground for new electric vehicles but in the neurons in the brain to conceive, build, and drive them.

It remains my deep honor and privilege to serve you well.

Pat Zumbusch

Founder and CEO

[i] “How Population Decline Could Upend The Global Economy” (Jared Franz, Capital Group, March 21, 2024)

[ii] The Ratio Of Workers to Social Security Beneficiaries Is At A Low And Projected To Decline Further” (Peter G. Peterson Foundation, August 4, 2022)

[iii] “Frequently Requested Statistics on Immigrants and Immigration in the United States” (Jeanne Batalova, Migration Policy Institute, March 13, 2024).