Presuming we are rational people, when we invest, we do so with the expectation of having more money later than we do now. Everyone says “well, naturally, of course” to that comment, but evidence would suggest our investing prowess is poor. Further, investors should also invest with the highest probability of winning and, while we’re at it, not just going up in value but increasing by the amount we deserve given the risks we are taking. Thus, optimizing our investment approach is 4th in the list of the Top 7 steps to be financially successful and we are addressing it in this month’s article.

Spoiler alert: you can invest in what is known as ‘actively managed funds’ or you invest in a competing philosophy called ‘passively managed funds’. If you look at all the data, it is hands down that passive works better for the investor as measured both by performance and the consistency of performance.

To make you wiser and understand, first we will provide some context and definitions to set the stage. Investing is most often done in one or two major categories – stocks (equities) or bonds (fixed income). Though the investment philosophy conclusions derived below are the same, we’ll just concentrate on the stock side today.

“Actively managed”, as a term, means you pay someone (generally a fund manager) to be wise on your behalf and pick the right securities (shares) to hold in your portfolio. ‘Right’ would be generally defined as finding the security that’s going to go up in value and buy it cheap and, alternatively, to sell the one that’s going to go down. You have to admit, that’s unbelievably appealing. Sometimes they buy / sell a stock (called “Security Selection”) and sometimes they say the Energy companies will do better than the Healthcare ones (called “Sector Rotation”). Then, lest we miss the obvious guttural appeal, sometimes those highly paid portfolio managers seek to determine if it’s a good time to be in the market, or maybe it’s a bad time (a rose by any other name, it’s still called “Market Timing”). “Passively managed” – the alternative philosophy – fundamentally says I don’t know which stock is going up today or what sector is going down, so I’ll just hold them all. It’s the haystack versus the needle approach, but you have to admit finding the needle would be really cool.

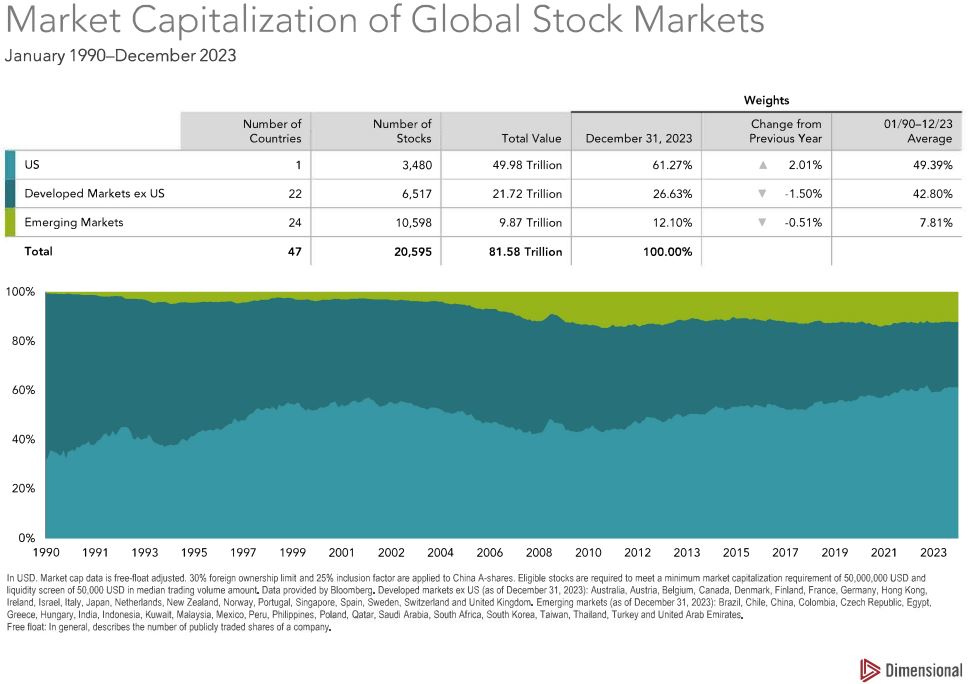

Then, let’s talk about the size of the markets because we have to know how big of an animal it is that we’re trying to take down. As seen on the graph below, the total worldwide traded exchanges for stocks totals $81 trillion dollars (December 31, 2023)[i].

The United States stock exchanges hold a remarkable 61% of that total, or about $50 trillion. I say ‘remarkable’ given that the population of the USA (~347 million) comprises less than 5% of the total world population (8.163 billion)[ii]. But here’s where it gets interesting. In that market, roughly 11 billion shares are traded each day[iii]. Research data says that there are 9.6 million daily traders active each day[iv]. ‘Small lot’ shares are traded in volumes of 100 shares each (retail investors), and ‘block share’ transactions are the equivalent of 10,000 or more shares (institutional investors), but in just sheer numbers that’s simply a heck of a lot of people trying to find that particular needle.

Finally, given all that forementioned competition, combined with the reality that all financial information must be released to the public simultaneously (see SEC “Regulation Full Disclosure 2000”), you’d be naturally inclined to believe it’s tougher now than ever to believe you have unique data that no one else has in their possession. But then again, hope springs eternal. If you add to the volume of those 9.6 million human traders the millions of trading algorithms in the market each and every day done by quantitative analysis firms (called ‘quants’), that climb to the top of the mountain is getting harder. Cap that hard-to-bake cake off with the explosion in Artificial Intelligence capabilities and it gets really hard to breathe at that elevation. If you somehow would possess unique financial intelligence provided by a company executive inside, then you got ‘insider trading’ violations and, in that case, as Dorothy said: “We’re not in Kansas anymore Toto”.

Now you have context. But beyond sounding like a nerd at the office water cooler like me, you don’t care about context. You care about results, as you should. So, here are the results:

- The data says only 1%-3% of day traders consistently earn above market returns[v].

- For professional portfolio managers, the research is very clear that 60%-90% of all funds fall short in performance of their benchmark index over a 5-year rolling period[vi]. That shortcoming has been repeatedly happening for more than 30-years, robbing investors of the returns they deserve. To add insult to injury, they charge you higher fees (AIE) for this privilege.

- If you are a diversified portfolio (which you should be; see last month’s letter), then given point #2 above, you would have one portfolio weak link (fund) combined to another weak link and you’ll find the likelihood of your falling short of what you deserve in returns (the whole chain, or for the investor their portfolio) is 95%-98% over any 10 or 20-year period[vii] – which, frankly, is within EVERYONE’s lifespan. It’s horrendous!

- Given the above reality, it’s no wonder that Actively-Managed funds have been steadily losing market share since John Bogle (Vanguard) introduced the first publicly traded index fund in 1975. Even in 2010, only 19% of all assets managed by investment companies were passive[viii]. In January of this year, the teeter-totter shifted to where passive is now more than 50% of outstanding investments.[ix]

With Wellspring, you are in a unique class of passive funds (what I have historically referred to as massively-diversified actively-filtered). Because these funds are not straight index, rather than falling short in performance they actually beat their respective institutional indices (benchmarks) 62%-84% of the time over 10 and 20-year periods, which is extraordinary. That’s akin to buying the whole haystack (safety) and getting a deal while you are doing it (smart). But keep in mind everyone can assemble a portfolio of index funds and they’d beat the pants off the majority of investors. Plus, they’d have less stress, take better care of their families and the causes they care for in the process.

It remains my deep and distinct honor to serve you well.

Patrick Zumbusch

Founder and CEO

Wellspring Financial Partners ®

“Market Capitalization Of Global Stock Markets” (Dimensional Market Summary, December 31, 2023)

[ii] USA and World Populations Clock (Worldometer.com, October 28, 2024)

[iii] “US Equities Market Volume Summary” (Nasdaq Trader.com website, October 27, 2024)

[iv] “14 Plus Fascinating Day Trading Statistics For 2024” (Traders Worldwide, Broker Notes, Hristina Nikolovska, February 26, 2024)

[v] “The Data On Day Trading; Separating Myths From Reality” (Current Market Valuation.com, updated October 14, 2024)

[vi] “Standard And Poors Versus The Index” (SPIVA, December 31,2023)

[vii] “The Power of Passive Investing: More Wealth with Less Work” (Richard Ferri, Wiley Books, November 2020)

[viii] “The Dominance Of Passive Investing And Its Effect On Financial Markets” (The UCI Paul Merage School Of Business, October 1, 2024)

[ix] “It’s Official: Passive Funds Overtake Active Funds” (Adam Sabban, Morningstar, January 17, 2024)