In Ernest Hemingway’s book “The Sun Also Rises”, an interlocutor asks a man how he came to bankruptcy. The answer was: “Two ways. Gradually, then suddenly.” I urgently encourage you to believe that we are dangerously mimicking that situation on a national level. What is at risk is not just money; it’s our freedom.

We have a growing debt problem in the United States. I’m not talking about credit card debt which is certainly growing – and I’ll refer to later as it’s instructive. Rather, I’m talking about the country’s debt, the sovereign national debt owed by the United States of America. The problem is very real, but similar to the story of a frog not jumping out of a pot of boiling water, we have become inured to it. Also, I feel we don’t talk about the federal debt in any constructive fashion because the current polarization of politics is sufficient to sideline what should be an objective conversation. However, we will dedicate this month’s letter to trying to help characterize the problem, exploring the genesis and extent of the issue, and the severe economic impacts to our way of life if not corrected.

Given the complexity and scale of the issue, we need a way to frame the topic. The framing that I think will help is threefold:

- First, in a purely monetary sense (via the Treasury Department), the USA government is primarily a transfer mechanism; It collects taxes from one group (generally based on income, but excise and gas taxes also contribute) and pays the money collected to others (be that people who have no or low income, wages of federal workers who do this work, or on actual things like paperclips, bridges, bombs, buildings, etc.).

- Secondly, recognize that debt itself is not a bad thing, as the government naturally incurs some debt when it builds airports, bridges and highways. That debt is incurred to boost and secure the nation’s capacity for productive growth as well as improve our way of life. Roads and airports last a long time, so it makes sense to not pay that debt off immediately as it helps to finance the debt over the period of its use. It’s akin to an individual buying a home and having a mortgage. That debt is generally good debt and studies have shown it to be a key component to long term financial success of households.

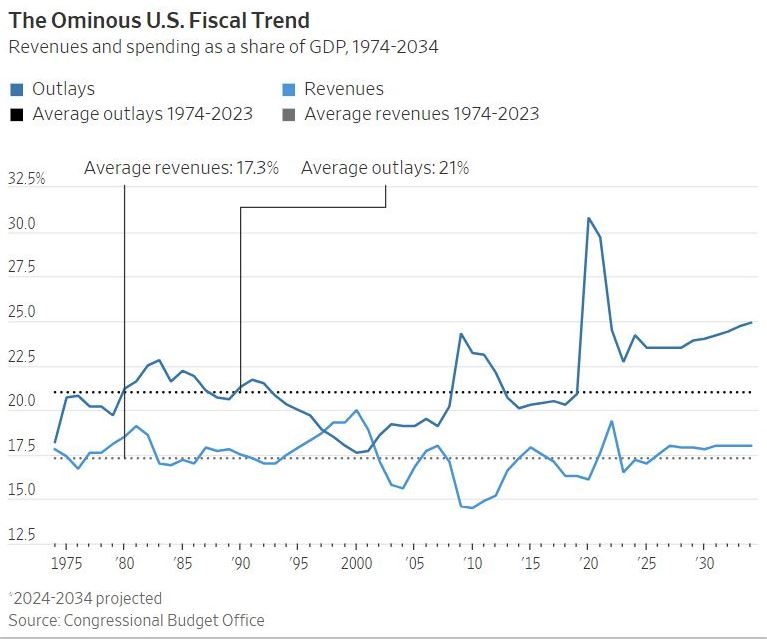

- Thus, if debt per se isn’t bad, and the legal right of Congress to tax isn’t the problem, then the remaining relevant issue pertains to how much debt this nation incurs and the reason that debt is taken on. A very basic tenet of good household finance is that you should pay your credit card off each month, but you would never pay your mortgage off each month. Thus, you need to watch how much money you put on your credit card – how much monthly spending you regularly do. That leads me to the third framing concept I’d offer up; The level of ‘credit card debt’ that the USA incurs is commonly measured and expressed as a percentage: How much of our annual national product is spent by the Federal government. As a matter of history, that figure has historically been roughly ~20%. As the economy grows (very important), then the spending of the United States government would naturally go up with it. If taxes collected, however, matched the same 20% annual outflows, no new debt would be taken on. Historical revenues to the federal government have averaged 17.3%[i] per annum, so we always were spending a little bit more than the income coming in – but we are in a brave new world as you’ll see in the image below:

Now that we have our national debt concepts down, let me simply lay out some plain but painful facts:

- When the United States started, a long time ago on another July 4th Independence Day, the country had no federal debt. Frankly, it was viewed a little dicey whether we’d actually make it as a new country, and no one would have lent money to a country who had an unproven chance to repay.

- Income taxes in the United States didn’t exist until 1913 (to be fair, they were first initiated by President Lincoln in 1862 to help pay for the costs of the Civil War, but public opposition was so high that the income tax was repealed in 1872[ii]).

- As recently as 20 years ago (September 30, 2004), roughly 230 years after the country was born, the level of national debt was $7.4 Trillion (less than $25,000 per person)[iii]. In the past 20 years, however, (June 25, 2024), we have spent money like a drunken sailor and increased the national debt to $34.7 Trillion (more than $100,000 per person)[iv].

- The annual GDP of the United States is currently $28.4 Trillion[v]. Normalized federal government spending projected is at a record 24.2%…and is expected to stay there for the next 10 years.

- Because of the size of the debt, spending on interest costs just to service the debt, will all by itself exceed $1 Trillion per year. Interest costs ALONE will exceed the total Department of Defense budget…and we don’t have a declared war going on. In 10 years, it is estimated the then $1.7 Trillion interest cost will exceed even Medicare expenditures[vi] – and Medicare itself is going broke and needs to be fixed.

- There is no recession or massive unemployment right now. We are running deficits at 7% of GNP…a level of expense that will drive the federal deficit from 97.1% of GNP last year to 122.4% in 2034. If you want to know some global counterparts and bad company examples:

- Italy…’the sick man of Europe’ has a debt / GNP ratio of 140%

- Japan…a country stuck in the doldrums for the past 40 years; 214%[vii]

The above simply highlights that when you spend too much, you put yourself in a hole. You simply deny yourself the freedom to do the things you need to do. We ALL know this happens in our household, where we have to make choices on what we can afford, and it’s not magic. When interest rates were at a lower level, the pain certainly was less, but no matter how you look at it, servicing the debt is restricting us from spending money on other national priorities. Oddly, the higher government spending is driving UP prices (inflation) and inflation is driving up interest rates, both which hurt the poor more than richer Americans. The solution to the issue is not taxation alone, or even primarily; It is spending. Plain and simple; Our eyes are bigger than our belly, and we have a spending problem — and both Republicans and Democrats are to blame. You have to say ‘No’ somewhere now or we’ll have to say no everywhere later.

In “The Rise and Fall of Great Powers”[viii], a classic book that unearths the decline of powerful civilizations, it was found the common precipitating factor was their economic decline due to unsupported (and supportable) government (empire) spending. These sovereign powers eventually lost their ability to dictate their own future…because they weren’t strong enough economically to protect their homelands against rogue nations. Unfortunately, we still have “bad actor” nations in this world, and it is incumbent on our leaders (Legislative and Executive branches) to protect the United States and its freedoms. It is an unforgiving reality that the country needs to be economically robust to facilitate that end. Hard-working wealth-creating businesses and households need that freedom to continue to pay their taxes – which is the essential source of money that the government spends.

Sooner or later…’suddenly’ will come. And when it does, we will ask our grandchildren to pay for it because we didn’t have the courage to take care of it ourselves. The good news is that the United States remains the most productive wealth-generating country on earth, and we CAN solve the issue. We just need the political will and leadership to protect those freedoms before it’s too late.

It remains my deep and distinct honor to serve you well.

Patrick Zumbusch

Founder and CEO

[i] “Soaring U.S. Debt Is A Spending Problem” (Wall Street Journal, June 20, 2024)

[ii] “Historical Highlights of the IRS” (IRS Website, June 27, 2024)

[iii] “Historical Debt Outstanding” (Fiscal Data, United States Treasury Department Website, June 27, 2024)

[iv] “What Is The National Debt” (Fiscal Data, United States Treasury Department website, June 27, 2024)

[v] Gross National Product; 1st Quarter 2024 (FRED, Economic Data, Federal Reserve of St. Louis, June 27, 2024)

[vi] U.S. Debt on Pace to Top $56 Trillion Over Next 10 Years” (Alan Rappeport, New York Times, June 18, 2024)

[vii] Central Government Debt: International Monetary Fund (website, June 27, 2024)

[viii] “The Rise And Fall Of The Great Powers” (Paul Kennedy, First Vintage Books, January 1989)