Tracking your finances is essential to financial success. It’s easy to get into a habit of spending without checking your finances, but this can lead to financial problems over time. Keeping track of your household’s finances helps you understand where your money is going and ensures that you’re living within your means.

Five steps to keeping track of your household’s finances are:

1. Create a Budget

The first step in tracking your finances is to create a budget. A budget is a plan for how you’ll spend and save your money. You’ll need to determine how much income you have each month and then set up categories for living expenses such as housing, food, transportation, and entertainment. A budget will help you oversee where your money is going and make certain you’re not overspending.

2. Set Up a Savings Plan

Another fundamental step in tracking your finances is to set up a savings plan. A savings plan is a way to put money away for future expenses or investments. You should set up a plan that works best for your situation and stick to it. This plan could include putting money into a savings account each month, investing in stocks, or setting up an emergency fund.

3. Set Financial Goals

Another aspect of setting up a savings plan is creating goals to work toward. Having financial goals can help you stay motivated and on track with your finances. Whether you’re saving for a house, retirement, or college, setting short-term and long-term financial goals can help you stay focused.

4. Track Your Spending

Once you’ve got a budget, savings plan, and financial goals in place, it’s essential to keep track of your spending. You can do this by monitoring your monthly expenses and comparing them to your budget. This step will help you identify areas where you’re overspending and can help you adjust your budget and/or spending accordingly. You can also use online budgeting tools to help you track your expenses and stay on budget.

5. Review Your Finances

Finally, it’s crucial to review your finances regularly. Checking your finances frequently will help you stay on track and ensure your budget and savings plan is working for you. It’s also a good idea to review your monthly credit card statements to verify you’re not being charged any hidden fees or overcharged for any services.

The Track to Financial Success

Tracking your household’s finances is essential to financial success. It can feel overwhelming at first, but once you get the hang of it, it will become easier and more manageable. By following the five steps outlined above, you’ll be able to make sure that you’re living within your means and starting to build wealth for the future.

Get Help Reaching Your Financial Goals

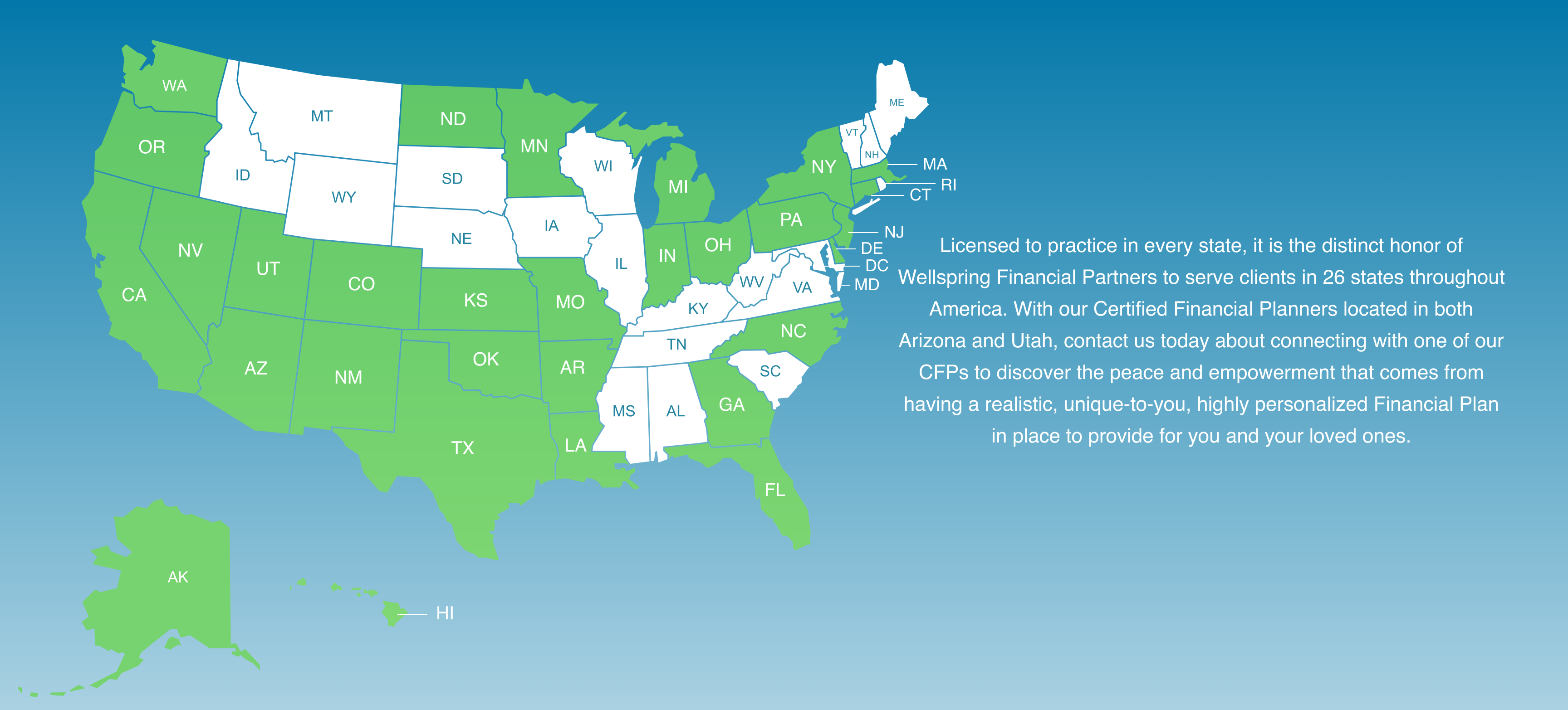

Keeping track of your household’s finances doesn’t have to be stressful. With help from the professional advisors at Wellspring Financial Partners, you can take financial control over your life. We can help you reach your goals and plan for the future with services like financial advising, financial planning, investment advising, and investment monitoring.

For more information about our individual wealth management services, contact us today.

Wellspring Financial Partners, LLC does not provide tax or legal advice. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.